Superior Shells™

Integrating a Superior Shell into a go public offering increases valuation, ability to raise capital and your chances of success

Why Use a Superior Shell

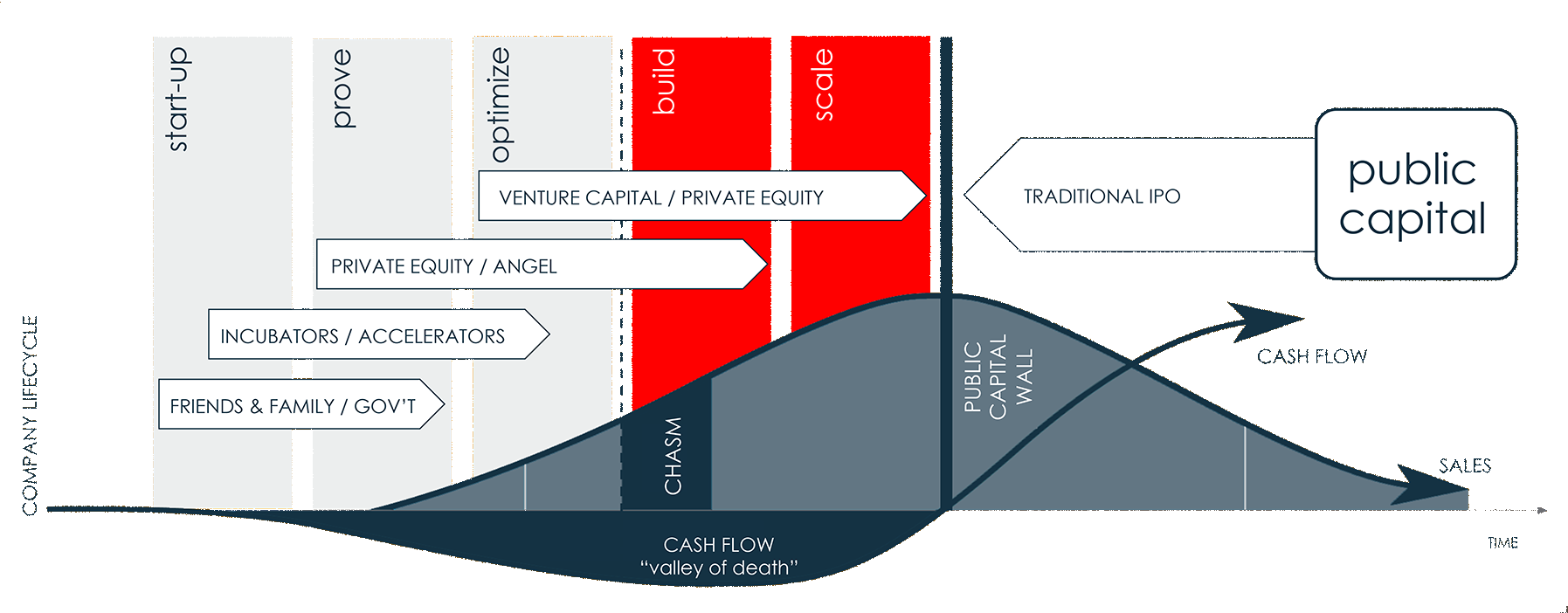

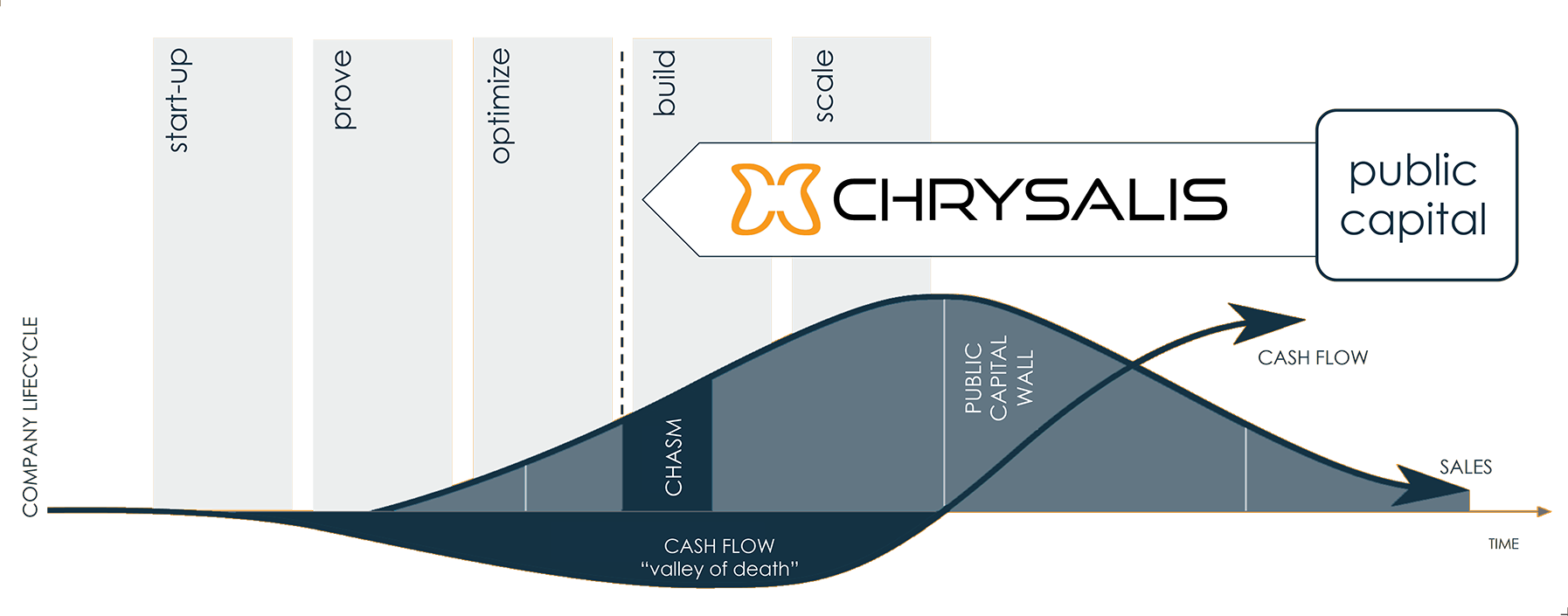

Countless companies seeking growth capital don’t fit or don’t share venture capital / private equity thesis; significantly impacting their ability to raise growth capital at acceptable valuations.

Accessing public venture capital earlier via a Superior Shell allows companies to access new sources of equity at higher valuations; allowing them to “step” into public markets without losing control.

Our Superior Shell Advantages

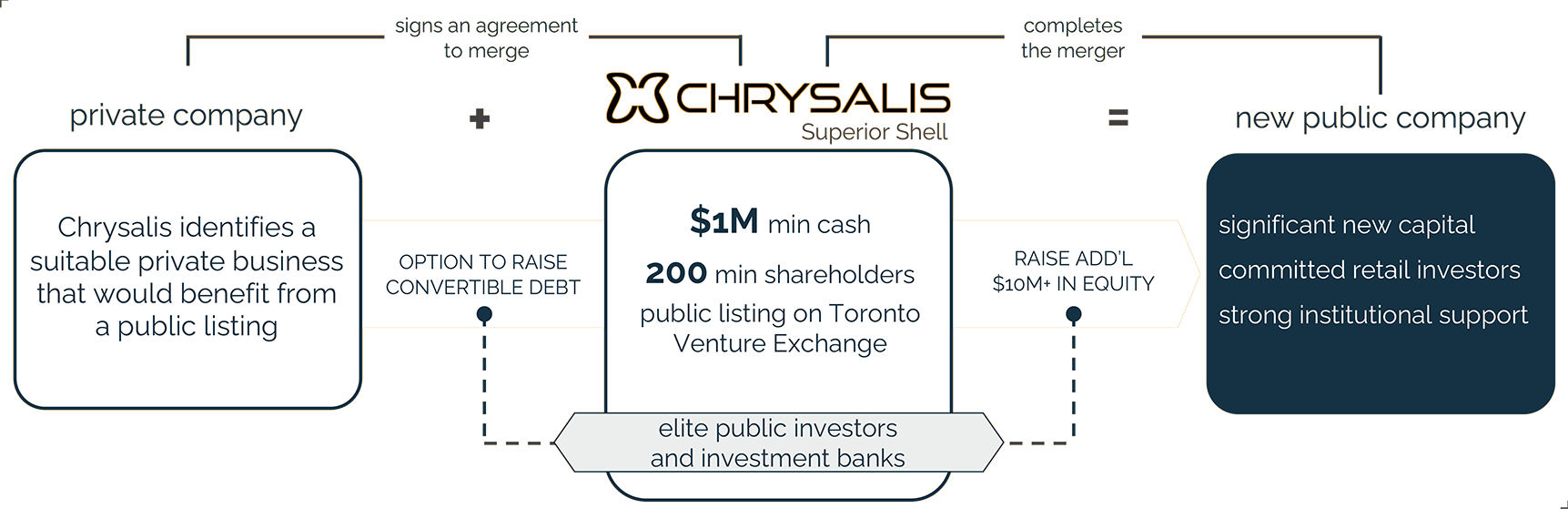

Our Superior Shells are built off the foundation of the Capital Pool Company (CPC) program and the Special Purpose Acquisition (SPAC) structure. A CPC or SPAC by itself is simply a set of rules that permits certain qualified groups to create regulated shells to facilitate reverse takeovers onto Canadian stock exchanges.

It’s not until Chrysalis layers on decades of experience with these structures that their true power is unlocked. Meticulous planning, oversight and alignment has allowed us to complete every Qualifying Transaction we’ve entered into.

All Shells Are Not Created Equal…

Greater Certainty

When used properly and managed by an experienced group, a Superior Shell dramatically increases a company's chances of successfully raising funds and listing onto a Canadian stock exchange.

"Jump the Queue"

Companies are able to skip the long wait times associated with traditional Initial Public Offerings. This can only be accomplished if the group behind the Superior Shell is recognized as a leader in sourcing quality transactions.

Structured Process

A Superior Shell is a highly planned and organized structure. Our goal is to identify all potential risks to closing up front, long before the process begins and money is spent.

Lead Order

Chrysalis Superior Shells are composed of sophisticated investors and are sufficiently capitalized to act as a lead order for a larger financing as well as an endorsement of the business from the shell's investment banking partners.

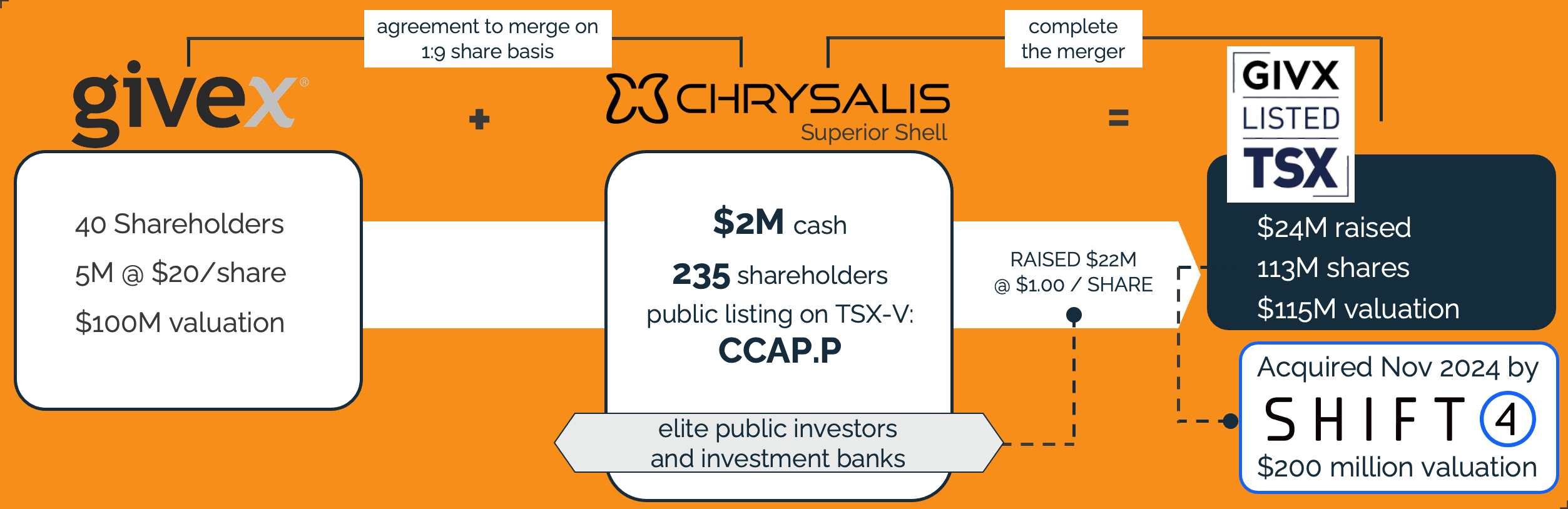

Superior Shell Case Study

CHALLENGE: Givex, a profitable online e-commerce platform founded over 20 years ago, wanted to raise a sizeable amount of capital, but was not interested in bringing on a private equity partner(s) or potentially lose control during the process.

OUTCOME: Using a Superior Shell, Givex was able to raise over $22 million from a broad network of institutional and retail investors. As importantly, it was able to complete this within 3 months of signing up.